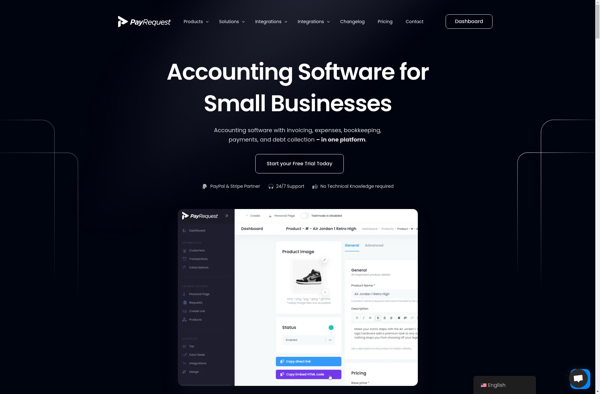

Description: PayRequest is an open-source, self-hosted payment request and donation management software. It allows individuals and organizations to easily accept online payments and manage donations by providing a customizable webpage with payment options.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

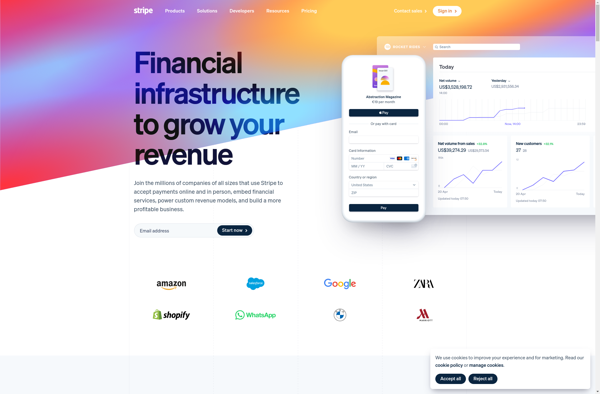

Description: Stripe is an online payment processing service that allows individuals and businesses to accept payments over the Internet. It provides the technical, fraud prevention, and banking infrastructure required to operate online payment systems. Stripe aims to simplify payment processing with easy-to-use APIs and excellent documentation.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API