Description: Paysera is an online payment platform that allows users to send, receive, and store money online. It offers services like digital wallets, payment cards, bank transfers, and other financial tools for individuals and businesses.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

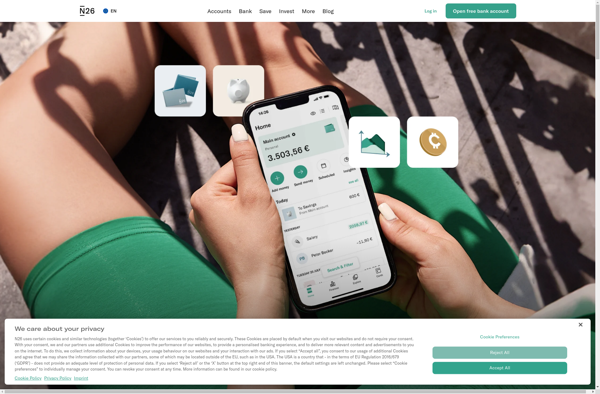

Description: N26 is a mobile bank that offers a free account with no hidden fees. It allows users to manage their finances, transfer money instantly, withdraw cash for free worldwide, and has budgeting tools and financial insights.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API