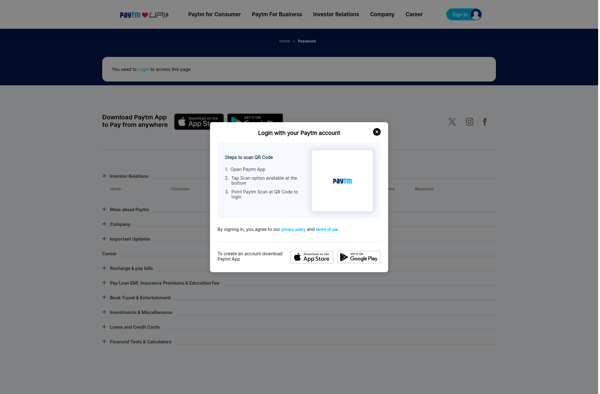

Description: Paytm Wallet is a digital wallet app by Paytm that allows users in India to make cashless payments. It supports payments using credit/debit cards, net banking, Paytm wallet balance and UPI.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Dwolla is a financial technology company that offers an online payment platform to transfer money between banks and businesses for a low flat fee. It allows fast and secure bank transfers without the high fees of services like PayPal or credit cards.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API