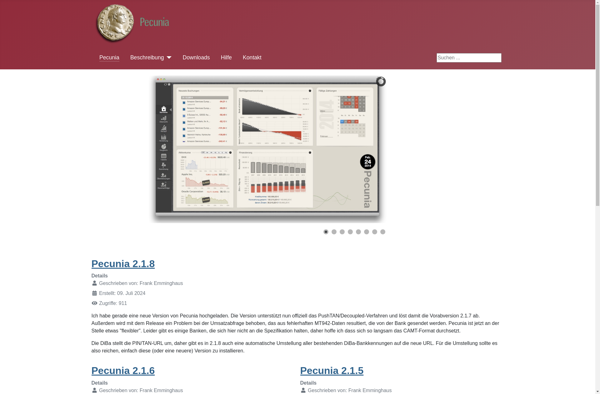

Description: Pecunia is an open-source personal finance manager and accounting software. It helps users track income, expenses, investments, budgets, and net worth. Pecunia has features for bank syncing, report generation, and custom categorization.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: CalendarBudget is a calendar and budget planning web application that allows users to schedule events, set budgets, and track expenses. It syncs with Google Calendar and features reporting tools to analyze spending habits over time.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API