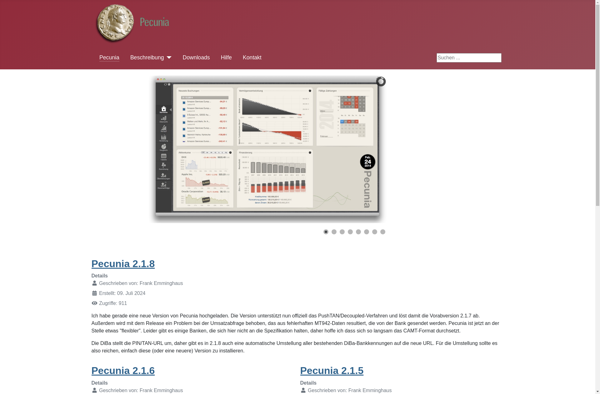

Description: Pecunia is an open-source personal finance manager and accounting software. It helps users track income, expenses, investments, budgets, and net worth. Pecunia has features for bank syncing, report generation, and custom categorization.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Outbank is a personal finance management tool that connects to bank, loan, credit card, investment, and other financial accounts to provide a consolidated view of your finances. It tracks income, spending, budgets, goals, and net worth over time.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API