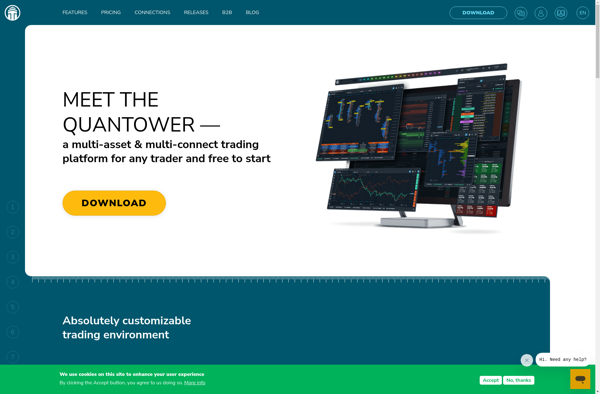

Description: Quantower is an advanced charting and trading platform designed for day traders, scalpers and analysts. It allows fast order execution, level II quotes, advanced charts with over 100 indicators, news feeds and screening.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Tiger Trade Soft is a trading platform designed for active stock, options, and crypto traders. It offers $0 commissions, advanced charts and analytics, and robust customization options in an easy-to-use interface.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API