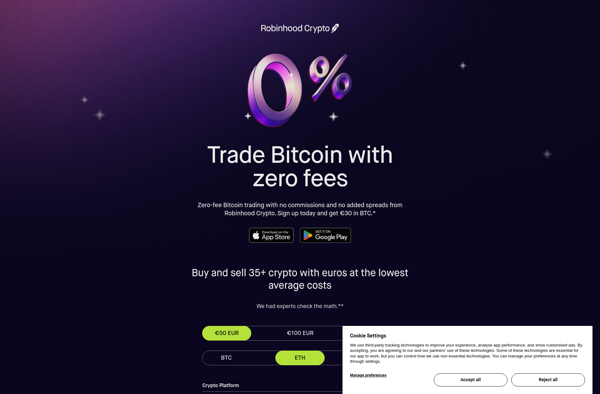

Description: Robinhood is a popular free stock trading app that allows users to buy and sell stocks, ETFs, options and cryptocurrencies with no commissions or fees. It has an easy-to-use mobile interface aimed at novice investors.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Protrader is a trading platform designed for active traders and investors. It provides advanced charting, level II quotes, screening tools, risk analysis, and paper trading capabilities to simulate live trading without risking real money.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API