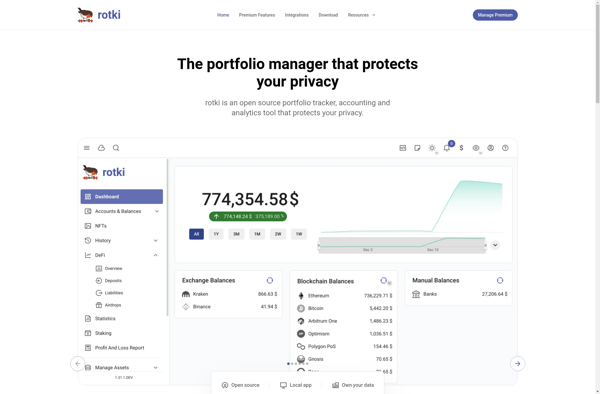

Description: Rotki is an open-source portfolio tracker and accounting tool for cryptocurrencies. It allows users to track their crypto portfolio across multiple wallets and exchanges, providing insights into profit/loss, cost basis, and more.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: CoinTracking is a cryptocurrency portfolio manager and tax calculator. It supports over 5,000 cryptocurrencies and integrates with various wallets and exchanges to automatically import trade data. Key features include portfolio tracking, profit/loss calculations, income tax reports, customizable accounting methods, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API