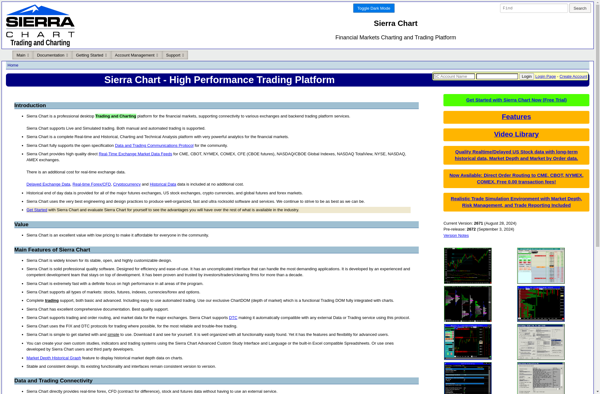

Description: Sierra Chart is a professional charting and trading platform for financial market data. It supports advanced analytics and automated trading strategies with its extensive functionality and highly customizable features.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Trade Interceptor is a popular trading platform and charting software for traders. It allows manual and automated trading on forex, stocks, futures and options, and includes advanced charting tools, trading indicators, backtesting capabilities, algo trading support and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API