Description: Skrooge is a personal finance manager application for the KDE desktop environment. It allows users to manage their finances including bank accounts, incomes, expenses, and standing orders. Key features include support for importing and exporting data, reporting, and scheduled transactions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

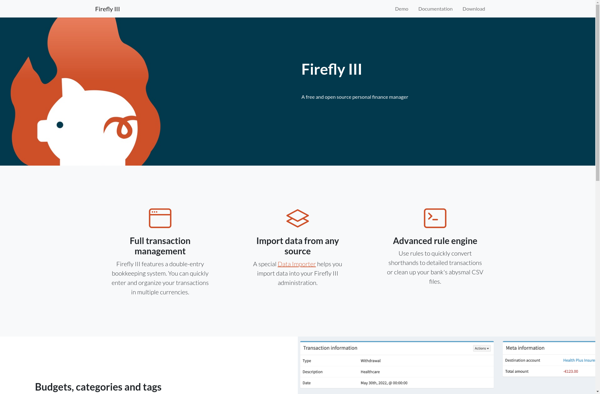

Description: Firefly III is an open-source personal finance manager that helps users track their spending and manage their finances. It offers features like budgeting, transaction reporting, and visualizing net worth over time.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API