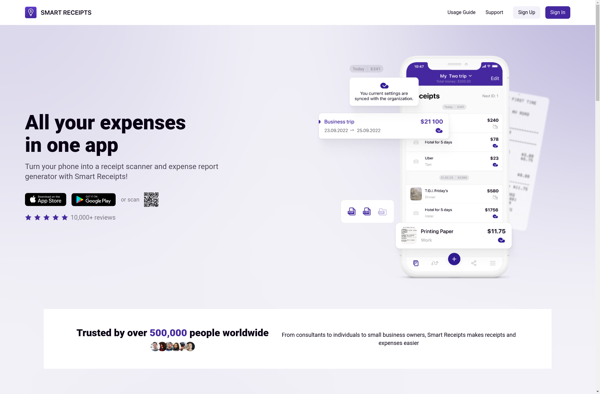

Description: Smart Receipts is a mobile app and web service that helps users track business and personal expenses. It allows users to capture and organize receipts, mileage, payments, and other expense data through their mobile device. Key features include automatic data capture from receipts, flexible categorization and reporting, support for multiple currencies, and integration with Google Drive for online backup.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Ride Receipts is a receipt and mileage tracking app designed for rideshare drivers. It automatically tracks trip info and generates detailed receipts for tax purposes.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API