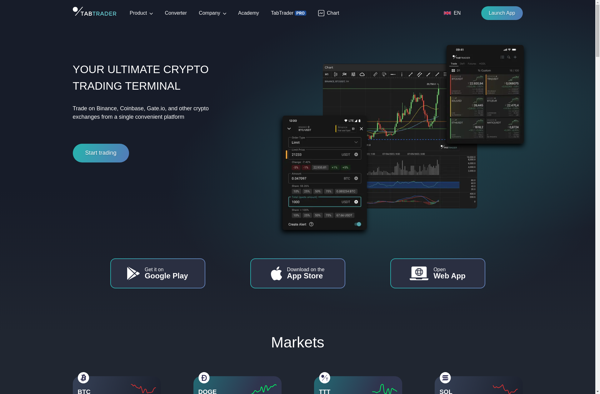

Description: TabTrader is a trading terminal and stock market scanner designed for Android and iOS devices. It allows users to trade stocks and ETFs from their mobile device via an interactive chart and real-time quotes.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Delta Investment Tracker is a personal finance app that allows you to easily track your investments, monitor performance, and make data-driven decisions. It syncs with your brokerage accounts and features intuitive charts, alerts, and custom reports.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API