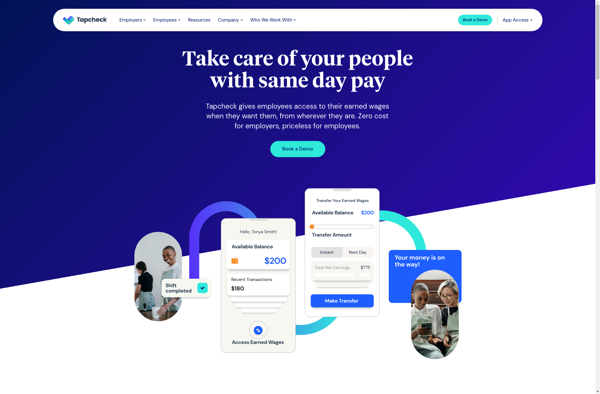

Description: Tapcheck is an app that allows employees to access their earned wages before payday. It integrates with payroll systems to allow early wage access through cash advances on accrued earnings.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Exilend is a free and open-source personal finance manager software for Windows. It allows users to manage bank accounts, incomes, expenses, budgets, reports, and more. The intuitive interface makes Exilend easy to use for personal finance tracking.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API