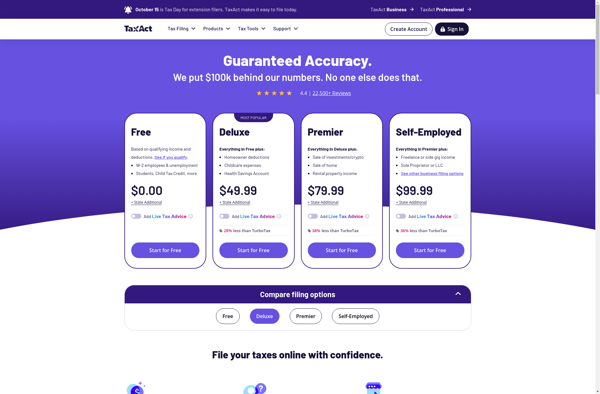

Description: TaxACT is tax preparation software that allows users to prepare and file federal and state tax returns. It provides a step-by-step interview process to guide users through tax questions, performs calculations automatically, checks for errors and missed deductions, and e-files returns directly to the IRS and state agencies.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

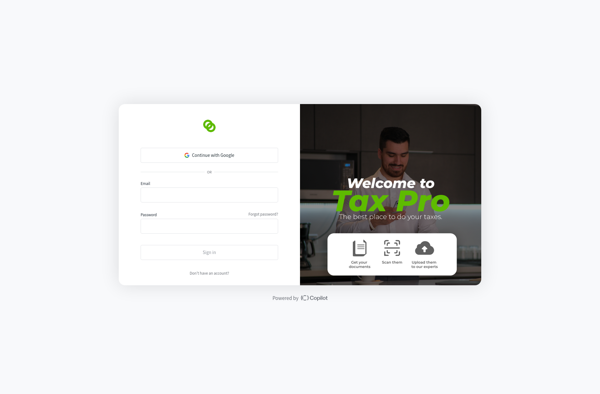

Description: IOOGO Tax is tax preparation software designed to help individuals and small businesses prepare and file their taxes. It provides an intuitive interface to guide users through entering their financial information and claiming deductions and credits.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API