TaxACT

TaxACT: Tax Preparation Software

TaxACT is tax preparation software that allows users to prepare and file federal and state tax returns. It provides a step-by-step interview process to guide users through tax questions, performs calculations automatically, checks for errors and missed deductions, and e-files returns directly to the IRS and state agencies.

What is TaxACT?

TaxACT is an affordable and user-friendly tax preparation software that helps individuals and small businesses prepare and file accurate federal and state tax returns. It uses an easy-to-follow interview format with plain language questions to guide users through the tax preparation process step-by-step.

Key features of TaxACT include:

- Supports all major forms and schedules for individual federal and state tax returns

- Uses decision-based interview questions tailored to the user's situation to identify tax deductions and credits

- Performs automatic calculations and checks for errors and missed deductions

- Allows e-filing of federal returns directly to the IRS and state returns to respective agencies

- Provides free customer support via phone, email, chat, and user forums

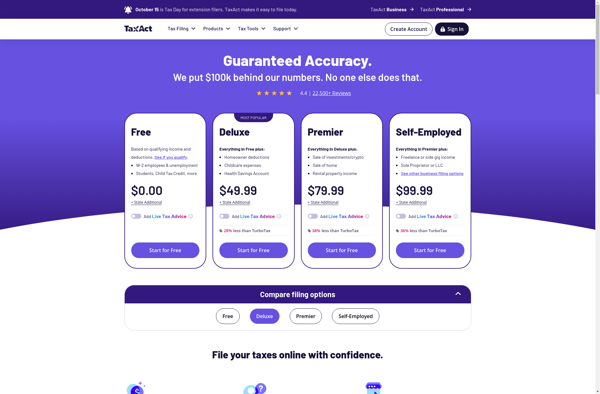

- Offers affordable pricing tiers based on complexity of return

- Has desktop and mobile app versions for convenience

With robust functionality wrapped in an intuitive interface, TaxACT enables DIY tax preparation for most personal and small business tax situations at a reasonable cost.

TaxACT Features

Features

- Simple step-by-step interview process

- Support for all major forms and schedules

- Automatic calculations and error checking

- E-file returns directly to the IRS and state agencies

- Access on multiple devices

- Live support from tax experts

- Audit assistance guarantee

Pricing

- Freemium

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best TaxACT Alternatives

Top Business & Commerce and Tax Preparation and other similar apps like TaxACT

Here are some alternatives to TaxACT:

Suggest an alternative ❐Intuit TurboTax

StudioTax

ItsDeductible

Open Tax Solver

Pigly

TaxCatalyst

FastnEasyTax

Cash App Taxes

SimpleTax

TaxPoint

WageFiling.com

IOOGO Tax