Cash App Taxes

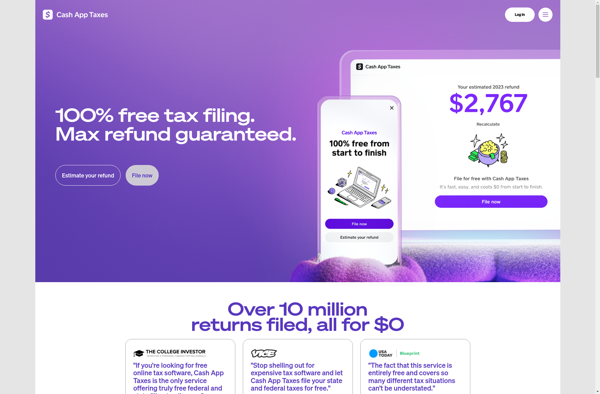

Cash App Taxes: Free Tax Filing Services

Cash App Taxes is a free tax filing service offered within the Cash App mobile payment application. It allows users to file simple federal and state tax returns directly through the app.

What is Cash App Taxes?

Cash App Taxes is a free DIY tax preparation and filing software service offered within the popular Cash App mobile payment application. It allows Cash App users to easily file their simple federal and state tax returns directly through the mobile app rather than using an external tax filing website or software.

Cash App Taxes uses guided questions to help users enter their tax information, taking advantage of the wage, payment, and banking data already available within the Cash App platform. It supports W-2 income, 1099-MISC income, unemployment income, student loan interest deductions, and several other common tax situations. The service includes free expert support if users have questions while filing.

After entering all tax information, Cash App Taxes calculates federal and state tax liability, including potential refund amounts, all within the mobile app. It also supports direct deposit for any tax refunds into the user's Cash App account. Cash App Taxes is best suited for simple, individual taxpayer returns rather than more complex filings.

Cash App Taxes Features

Features

- Free federal and state tax filing

- Simple and easy-to-use interface

- Integrates with the Cash App mobile payment app

- Supports W-2, 1099, and other common tax forms

- Automatic import of tax information from linked financial accounts

- Guided tax preparation process

Pricing

- Free

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Cash App Taxes Alternatives

Top Finance and Tax Preparation and other similar apps like Cash App Taxes

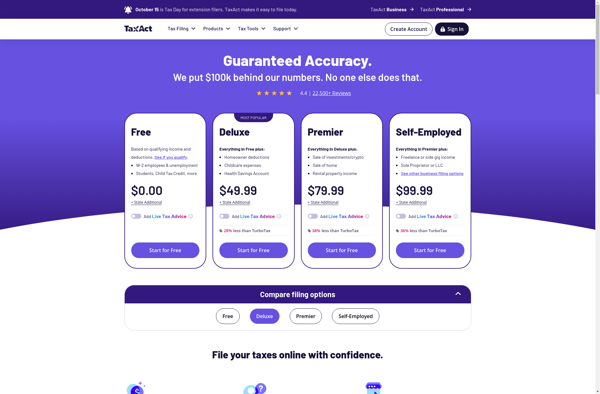

TaxACT

Pigly