Intuit TurboTax

Intuit TurboTax: Tax Preparation Software

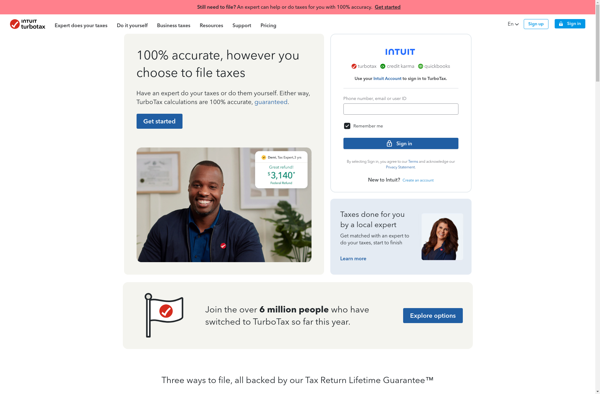

Intuit TurboTax is tax preparation software that helps individuals and small businesses file federal and state tax returns. It uses a question-and-answer format to guide users through the process step-by-step.

What is Intuit TurboTax?

Intuit TurboTax is a market-leading tax preparation and filing software used by millions of Americans to file federal and state tax returns each year. First launched in the 1980s as one of the first tax software solutions for personal computers, TurboTax utilizes a user-friendly, interview-style Q&A format to guide taxpayers through the entire tax filing process in a step-by-step manner.

By prompting users to answer simple questions about their financial situation, TurboTax is able to complete the necessary tax forms on their behalf, perform complex tax calculations, search for tax deductions and credits they may qualify for, and ultimately maximize their tax refund. Editions of TurboTax are available for a variety of tax situations, including homeowners, investors, small business owners, and tax filers with simple or complex returns.

Key features include a user-friendly interface, help and support from tax experts, maximum refund guarantees, 100% accurate calculations, electronic tax filing, robust data security, and mobile app access. Intuit frequently updates TurboTax to comply with the latest tax codes and forms from the IRS and state tax agencies.

Intuit TurboTax Features

Features

- Step-by-step guidance through the tax filing process

- Automatic import of tax documents and forms

- Personalized tax recommendations and deductions

- Audit support and advice

- Mobile app for on-the-go tax filing

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Intuit TurboTax Alternatives

Top Business & Commerce and Accounting & Finance and other similar apps like Intuit TurboTax

Here are some alternatives to Intuit TurboTax:

Suggest an alternative ❐StudioTax

Open Tax Solver

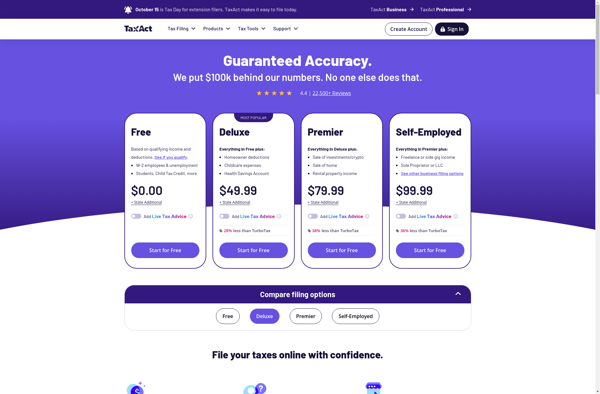

TaxACT

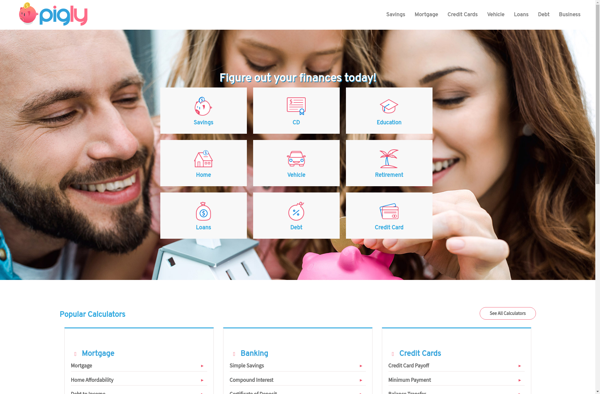

Pigly

TaxCatalyst

FastnEasyTax

SimpleTax

TaxPoint

WageFiling.com

IOOGO Tax