Open Tax Solver

Open Tax Solver: Open Source Tax Preparation and Filing Software

Open Tax Solver is an open source tax preparation and filing software. It allows users to enter their financial information and uses that to complete tax forms, estimate taxes owed, maximize deductions, generate completed returns to print and file.

What is Open Tax Solver?

Open Tax Solver is an open source, free tax preparation and filing software designed to help individuals complete and file their tax returns. It provides an intuitive interface for entering relevant financial information such as income, deductions, credits, etc. and uses this information to complete the necessary IRS tax forms.

Key features of Open Tax Solver include:

- Free to download, use and share

- Guided interview process to collect all relevant tax information

- Automatically selects appropriate forms and tax status

- Estimates tax liability and identifies potential deductions/credits

- Generates completed tax forms ready to print or e-file

- Securely saves tax returns for future reference and amendments

- Available for Windows, Mac and Linux operating systems

As open source software, Open Tax Solver's codebase is publicly accessible which allows for community contributions to features and functionality. It is updated annually to support latest tax codes and forms. The intuitive interface makes DIY tax preparation accessible for most personal tax situations.

Open Tax Solver Features

Features

- Free and open source tax preparation software

- Supports common IRS tax forms like 1040, 1040A, 1040EZ, etc

- Allows entering financial information to auto-complete tax forms

- Estimates taxes owed and suggests ways to maximize deductions

- Generates completed tax returns ready to print and file

Pricing

- Open Source

Pros

Cons

Reviews & Ratings

Login to ReviewThe Best Open Tax Solver Alternatives

Top Office & Productivity and Tax Software and other similar apps like Open Tax Solver

Here are some alternatives to Open Tax Solver:

Suggest an alternative ❐Intuit TurboTax

StudioTax

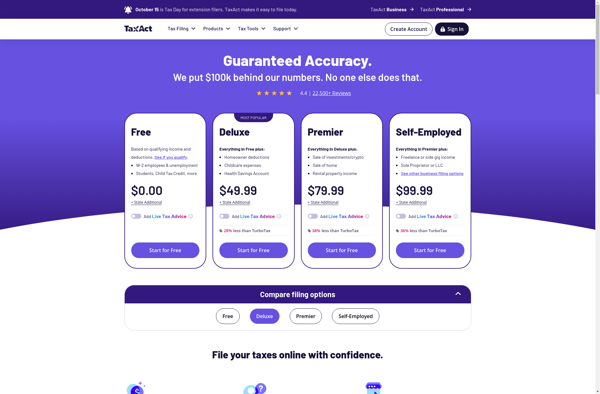

TaxACT

United States Salary Tax Calculator

FastnEasyTax

SimpleTax

AND CO Quarterly Tax Calculator

WageFiling.com