United States Salary Tax Calculator

United States Salary Tax Calculator: Calculate Federal State Local Taxes

A web-based application that allows users to input their annual salary and location in the US to calculate federal, state, and local income taxes. Provides a breakdown of tax rates and projections.

What is United States Salary Tax Calculator?

The United States Salary Tax Calculator is a free online tool designed to estimate an individual's tax liability based on their annual income, location, and personal situation. Users input their anticipated annual salary along with their state and city of residence. The tool then calculates federal, state, and local income taxes by applying the latest tax brackets and rates.

After entering the required inputs, users are provided with a detailed tax projection summarizing their total tax obligation. This includes a breakdown of federal income tax, Social Security and Medicare deductions, state income tax, and any applicable local taxes. For each category, the tool shows the effective tax rate applied based on tax brackets. It also estimates total taxes owed or refunds due.

Beyond the hard numbers, the United States Salary Tax Calculator offers personalized explanations to help users understand exemptions, deductions, and how different areas of the US tax code affect their bottom line. Users can experiment with different incomes and locations to see the impact on their tax liability. The tool is updated annually to reflect the latest IRS guidance.

By combining an easy-to-use interface with transparent tax calculations and rates, the United States Salary Tax Calculator aims to simplify personal tax planning for salaried individuals. It delivers the insights needed to estimate take-home pay and make informed financial decisions.

United States Salary Tax Calculator Features

Features

- Federal income tax calculator

- State income tax calculator

- Local income tax calculator

- Tax bracket determination

- Tax rate breakdown

- Tax liability projection

- Tax refund/owed calculation

- Tax planning tools

- Tax filing status options

- Multiple location support

Pricing

- Freemium

Pros

Cons

Reviews & Ratings

Login to ReviewNo reviews yet

Be the first to share your experience with United States Salary Tax Calculator!

Login to ReviewThe Best United States Salary Tax Calculator Alternatives

Top Office & Productivity and Finance and other similar apps like United States Salary Tax Calculator

Here are some alternatives to United States Salary Tax Calculator:

Suggest an alternative ❐Open Tax Solver

Visual Sm.Art

AND CO Quarterly Tax Calculator

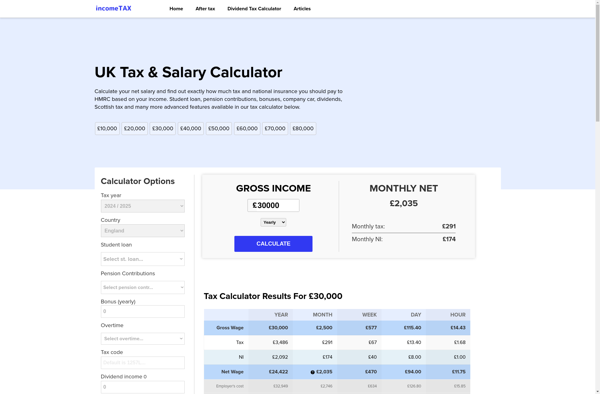

Income Tax UK