Income Tax UK

Income Tax UK: Self-Assessment Tax Preparation Software

Tax preparation software designed for UK residents to file annual self-assessment tax returns, guiding users through income reporting, allowable expenses, and more.

What is Income Tax UK?

Income Tax UK is an easy-to-use tax preparation and filing software tailored for UK residents. It is designed to help individuals, self-employed, landlords, and small business owners accurately complete their annual self-assessment tax returns.

The software provides an intuitive interview-style questionnaire that guides users through reporting details of their income, allowable expenses, tax reliefs, pensions, and more. It does the complex tax calculations automatically in the background and determines how much tax the user owes or if they are due for a tax refund.

Key features include:

- Step-by-step guidance on UK income tax rules and regulations

- Automatic validation and error-checking to avoid mistakes

- Support for common UK tax situations like rental income, dividends, capital gains

- Tax planning tips and reminders for tax relief claims

- Calculations for national insurance contributions and student loan repayments

- Free unlimited technical support and year-round tax guidance

By using Income Tax UK, individuals and small businesses can save time, avoid errors that lead to fines, maximize their tax savings and get peace of mind that their tax return filings are done right.

Income Tax UK Features

Features

- Step-by-step tax return filing guidance

- Automatic calculations to determine tax owed or refund due

- Support for common UK income sources and expenses

- Integration with HMRC systems for digital filing

- Data import from prior years returns

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Income Tax UK Alternatives

Top Business & Commerce and Accounting & Finance and other similar apps like Income Tax UK

Here are some alternatives to Income Tax UK:

Suggest an alternative ❐Visual Sm.Art

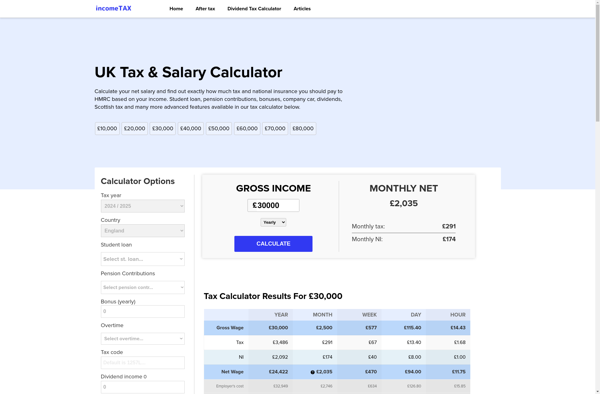

Income After Tax Calculator

United States Salary Tax Calculator