Income After Tax Calculator

Income After Tax Calculator: Calculate Your Net Income

An income after tax calculator is a tool that allows you to calculate your net income after accounting for taxes. It is useful for budgeting and financial planning.

What is Income After Tax Calculator?

An income after tax calculator is an online tool or software program that helps individuals and businesses estimate their net take-home pay after federal, state, and other taxes are deducted from gross earnings. These calculators account for various factors like filing status, number of allowances claimed, tax bracket, deductions and credits to provide an estimate of your final disposable income.

Income after tax calculators are extremely valuable for budgeting, financial forecasting and planning. They allow you to adjust variables like expected pay raises, bonuses, tax code changes etc. to project how much actual money you will have in hand. This helps make informed decisions about potential major expenses, investments, debt payments and savings goals. Most tax calculators are easy to use with a simple interface to input details like income, location, deductions etc. and provide instant estimates. More advanced versions even allow importing prior year tax returns or linking to payroll systems for greater accuracy.

Overall, an income after tax calculator is an essential tool for determining realistic disposable income and ensuring proper financial planning considering your unique tax situation. Making tax-informed money decisions helps safeguard economic stability and growth over time.

Income After Tax Calculator Features

Features

- Calculates net income after taxes

- Supports different tax filing statuses (single, married, etc.)

- Allows input of various income sources (salary, investments, etc.)

- Provides detailed tax breakdown and summary

- Saves and retrieves previous calculations

- Mobile-friendly design for on-the-go use

Pricing

- Free

- Freemium

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewNo reviews yet

Be the first to share your experience with Income After Tax Calculator!

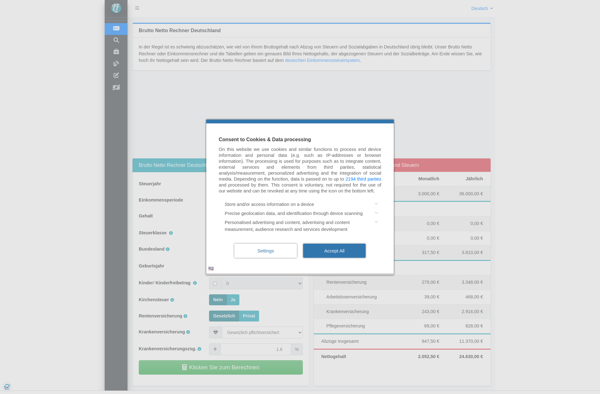

Login to ReviewThe Best Income After Tax Calculator Alternatives

Top Office & Productivity and Finance and other similar apps like Income After Tax Calculator

Here are some alternatives to Income After Tax Calculator:

Suggest an alternative ❐Visual Sm.Art

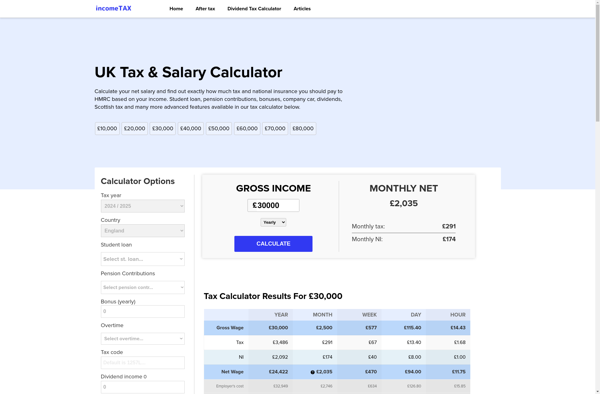

Income Tax UK