Description: Income Tax UK is tax preparation software designed specifically for UK residents to file their annual self-assessment tax returns. It guides users through the process of reporting income, allowable expenses, tax reliefs and more to calculate how much tax is owed or due for a refund.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

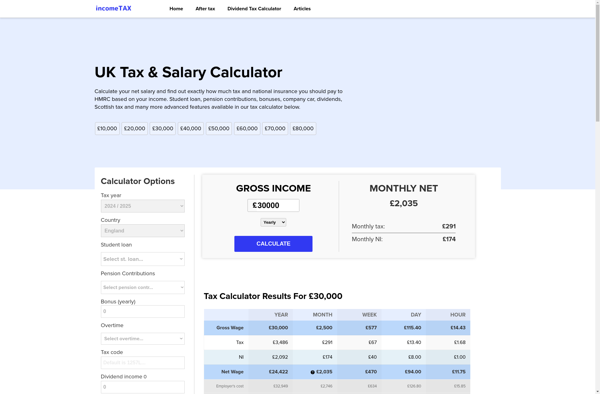

Description: An income after tax calculator is a tool that allows you to calculate your net income after accounting for taxes. It is useful for budgeting and financial planning.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API