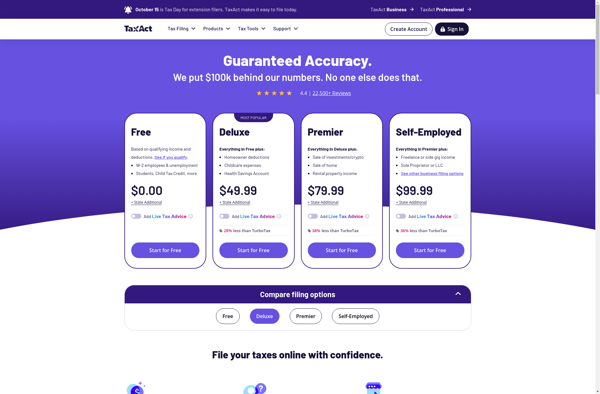

Description: TaxACT is tax preparation software that allows users to prepare and file federal and state tax returns. It provides a step-by-step interview process to guide users through tax questions, performs calculations automatically, checks for errors and missed deductions, and e-files returns directly to the IRS and state agencies.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: StudioTax is free tax preparation software for Canadians to file their personal income taxes. It provides an easy step-by-step process to enter tax information, make claims, and file returns with the CRA.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API