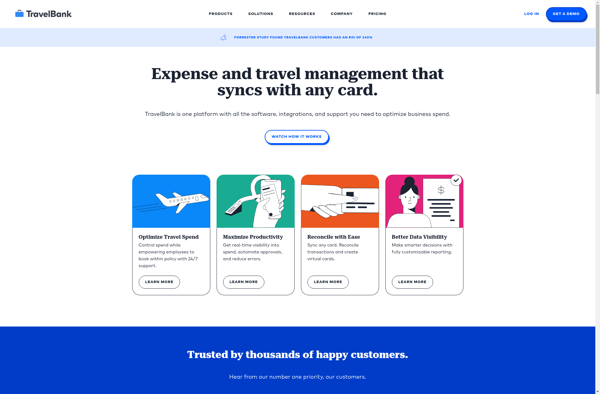

Description: TravelBank is a financial wellness platform that helps companies provide tax-free commuter benefits to employees. Employees can use pre-tax dollars to pay for transit and parking costs. TravelBank aims to reduce commute-related stress and environmental impact.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

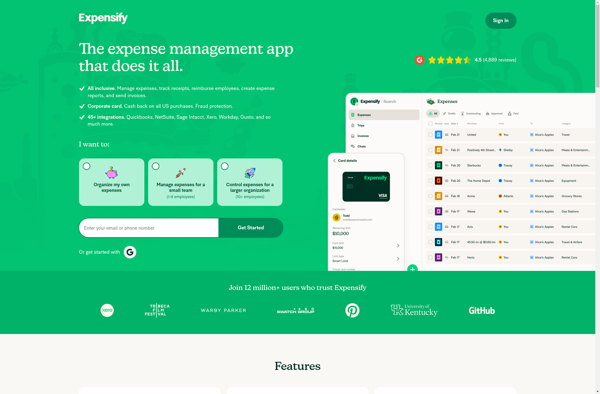

Description: Expensify is an expense reporting and management software designed for businesses. It allows users to easily track receipts, credit card expenses, mileage, and other expenses. Users can upload receipts via web, email, or mobile app. Key features include automated expense reporting, real-time policy enforcement, integrated invoicing, and robust approval workflows.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API