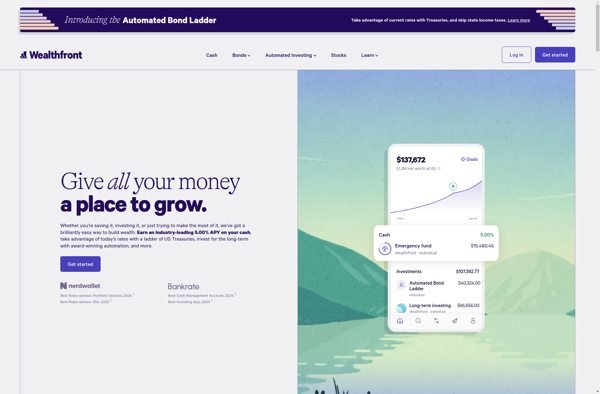

Description: Wealthfront is an automated investment service and robo-advisor that uses algorithms and software to build and manage customized investment portfolios based on a client's financial situation and goals. It aims to provide long-term, tax-efficient investing at low fees.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Retirety is a software that helps financial advisors manage their clients' retirement plans and assets. It streamlines the retirement planning process by providing tools for visualization, reporting, projections, and scenario analysis.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API