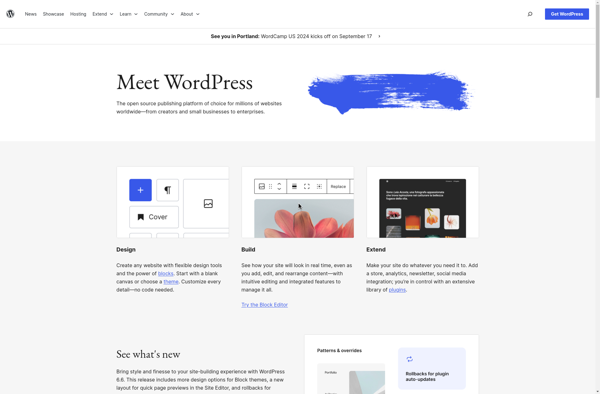

Description: WordPress is an open-source content management system based on PHP and MySQL. It has a large community of developers and users and is highly customizable through themes and plugins. WordPress is commonly used for blogging, ecommerce, and general websites.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: LifeYo is a personal finance and budgeting app designed to help users track spending, create budgets, and achieve financial goals. It offers easy tools to set budgets, manage bills, view spending patterns over time, and project future cash flow.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API