Description: Yodlee MoneyCenter is a personal finance management software that helps users track their spending, create budgets, analyze cash flow, and manage debt. It connects to over 16,000 financial institutions to automatically import transactions into the app.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

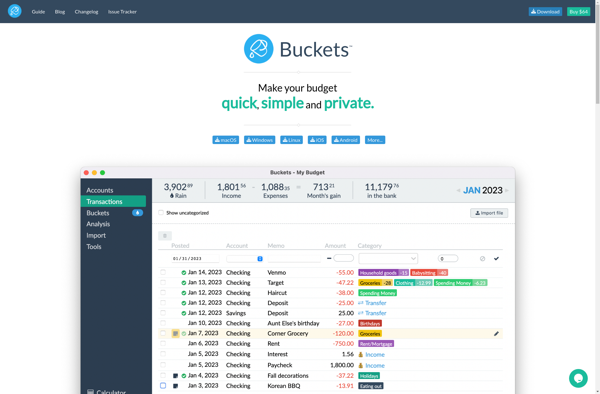

Description: Buckets Budgeting is a personal budgeting software that helps users control their finances by separating money into different categories or 'buckets'. It allows planning future expenses and savings goals.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API