Description: You Need A Budget (YNAB) is a popular personal budgeting app and service designed to help users gain control over their finances. It allows linking bank accounts to automatically import transactions and uses an envelope budgeting methodology to help users plan ahead and assign money towards specific spending categories each month.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

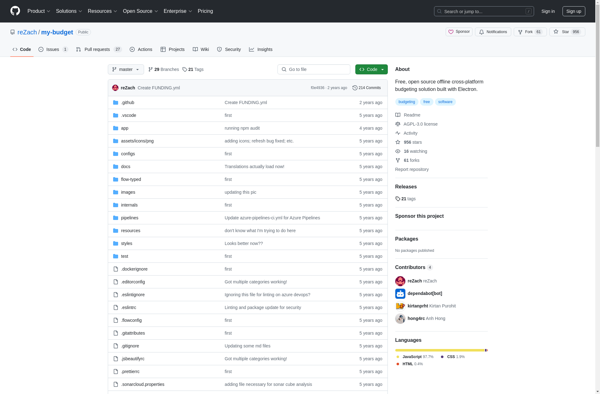

Description: My Budget is a personal budgeting and money management software. It allows users to track income, expenses, savings goals, investments, and net worth. Key features include budget planning, spending tracking, graphical reports, reminders, mobile app.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API