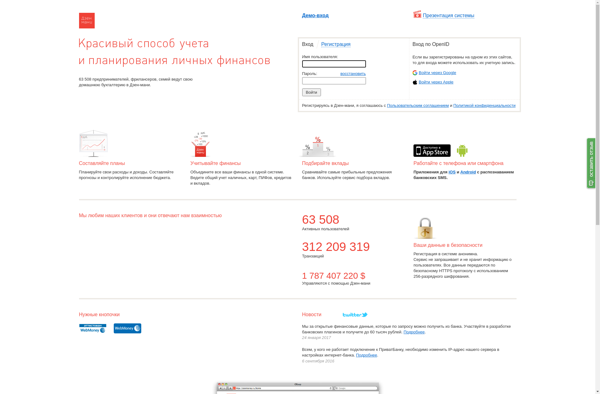

Description: Zenmoney is a personal finance manager and budgeting app for Android and iOS. It allows users to track income and expenses, create budgets, analyze spending habits, manage bank accounts and investments in one place.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

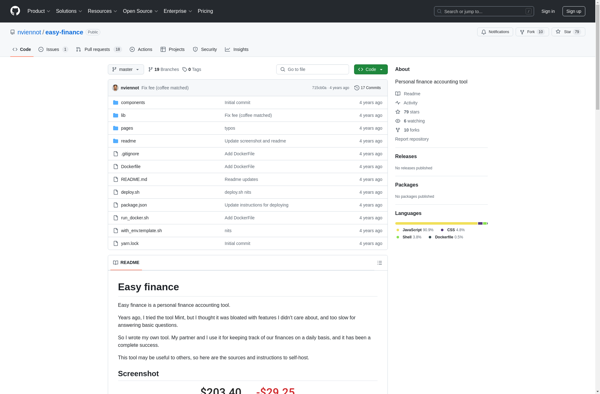

Description: easy-finance is an open-source personal finance manager software for tracking expenses, creating budgets, and managing money. It has an intuitive interface, customizable categories and reports, and bank sync features.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API