Dealroom M&A Software

Dealroom M&A Software: Intelligence for Strategic Acquisitions

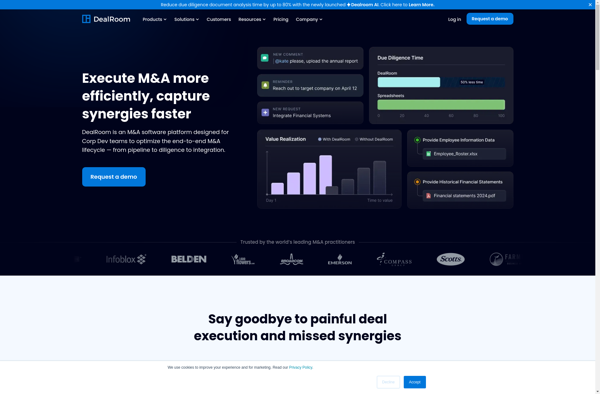

Dealroom is a data platform designed for mergers and acquisitions that provides business intelligence on startups, growth companies, investors, and ecosystems. It offers research tools to identify targets, analyze valuations, spot trends, and develop deal strategies.

What is Dealroom M&A Software?

Dealroom is an M&A software designed for dealmakers, investors, and advisors to accelerate growth through mergers and acquisitions. It provides actionable intelligence on startups, scaleups, ecosystems, transactions, and investors across the globe.

Key features of Dealroom for M&A include:

- Company profiles and growth analytics - Get a 360 view of target companies with funding history, valuation estimates, acquisition likelihood scores, business model analysis, investor ties, technology intelligence, corporate structures and more.

- Ecosystem maps and benchmarking - Visualize startup ecosystems, trends, and connections. Benchmark companies across valuations, funding stages, traction metrics, and technology strengths.

- Target sourcing - Use advanced filters and visualizations to identify M&A targets based on parameters like location, sector, business model, likelihood of exit, investor preferences and more.

- Competitive intelligence - Understand the competitive landscape with intelligence on competitors, market categorization, positioning, and SWOT profiles.

- Deal Marketing - Create customized deal collateral like investor memos and teaser documents using Dealroom’s data and templates.

- Portfolio monitoring - Monitor portfolio companies’ health, milestones, valuations to optimize investment decisions and exits.

Dealroom leverages AI and machine learning to continually enhance its data. It serves leading corporations, investors, and advisors pursuing their growth ambitions worldwide.

Dealroom M&A Software Features

Features

- Comprehensive database of startups, investors, acquisitions

- Powerful search and filtering tools

- Interactive maps and graphs

- Valuation analysis

- Target identification

- Deal strategy support

- News monitoring

- Exportable reports

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewNo reviews yet

Be the first to share your experience with Dealroom M&A Software!

Login to ReviewThe Best Dealroom M&A Software Alternatives

Top Business & Commerce and Mergers & Acquisitions and other similar apps like Dealroom M&A Software

No alternatives found for Dealroom M&A Software. Why not suggest an alternative?