Nest Egg

Nest Egg is a personal finance and budgeting software designed to help users save money and plan for retirement. It allows users to link bank accounts, track spending, set budgets and savings goals.

Nest Egg: Personal Finance and Budgeting Software

Nest Egg is a personal finance and budgeting software designed to help users save money and plan for retirement. It allows users to link bank accounts, track spending, set budgets and savings goals.

What is Nest Egg?

Nest Egg is a comprehensive personal finance and budgeting software application designed to help users take control of their finances, save money effectively, and plan for a secure retirement.

Key features of Nest Egg include:

- Connecting and syncing all bank, loan, investment, and credit card accounts in one place for a unified view of finances

- Setting up customized budgets and categories to track where money is being spent each month

- Auto-categorizing transactions and generating detailed spending reports and charts

- Establishing multiple savings goals such as emergency funds, vacations, or retirement savings

- Performing net worth tracking over time as assets and debts change

- Projecting retirement readiness based on current income, spending, savings, and expected retirement expenses

- Generating retirement savings advice and asset allocation recommendations from robo-advisor

- Accessing the service on web and mobile devices to manage finances on-the-go

With robust analytics, automatic alerts, saving and investing tools, Nest Egg empowers users to have better visibility and control over their financial lives.

Nest Egg Features

Features

- Budgeting tools

- Goal tracking

- Spending analysis

- Retirement planning

- Investment tracking

- Bill reminders

- Net worth calculator

Pricing

- Freemium

Pros

User-friendly interface

Automatic sync with bank accounts

Customizable categories and budgets

Long-term retirement planning tools

Educational resources on finances

Cons

May not integrate with all financial institutions

Limited mobile app functionality

Fewer features than some competitors

Official Links

Reviews & Ratings

Login to ReviewThe Best Nest Egg Alternatives

Top Business & Commerce and Personal Finance and other similar apps like Nest Egg

Here are some alternatives to Nest Egg:

Suggest an alternative ❐Delicious Library 3

Delicious Library 3 is a media cataloging and collection management application developed by Delicious Monster for macOS. It enables users to easily catalog and track their physical libraries of books, movies, music, and video games.Some key features of Delicious Library 3 include:Intuitive user interface for adding items by barcode scan,...

Sortly

Sortly is a user-friendly inventory and asset management software solution built to help businesses track merchandise, equipment, media assets, and more. It makes the traditionally tedious task of asset tracking simple through an intuitive interface and robust feature set.With Sortly, users can create unlimited customizable categories, fields, and attributes tailored...

Itemtopia

Itemtopia is an all-in-one ecommerce platform designed to help small businesses and entrepreneurs create professional online stores to sell their products or services. It provides a variety of easy-to-use tools to build and customize responsive online storefronts, manage product catalogs and inventory, process orders and payments, fulfill orders, and track...

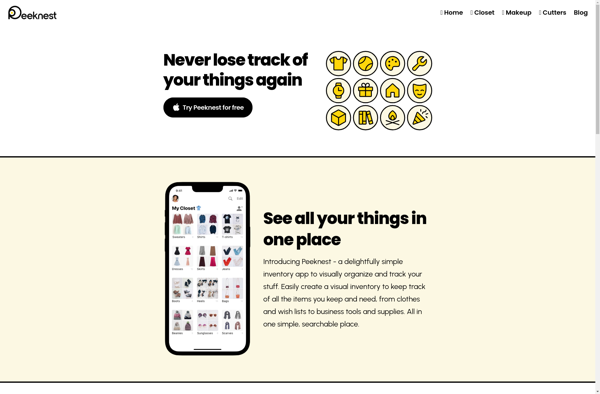

Peeknest

Peeknest is a user testing and feedback software designed to help product teams quickly and easily get video recordings and feedback from real users as they use your website, app, or prototype. With Peeknest you can:Recruit target users that match your audience personas and user groupsDesign and set up an...

Steward Database

Steward Database is an open-source database application designed for simplicity and ease of use. It provides an intuitive graphical user interface that allows users to easily explore, visualize, and make sense of their data.Some key features of Steward Database include:Visual query builder - Build queries by simply pointing and clicking,...