Description: 22 Dividends is a cloud-based dividend stock analysis software. It helps investors research, track, and analyze dividend stocks to build a passive income portfolio.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

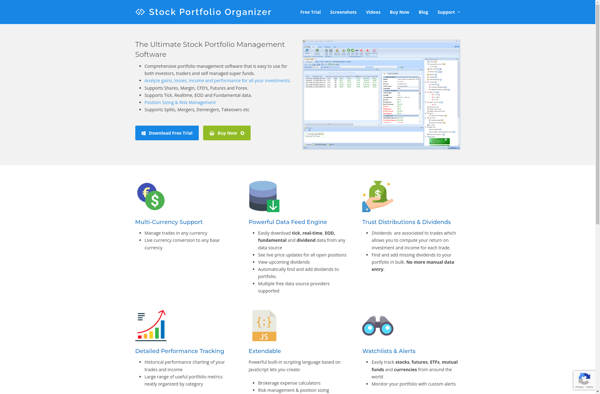

Description: Stock Portfolio Organizer is software designed to help investors organize, track, analyze, and manage their stock portfolios. It provides tools for entering buy/sell transactions, current positions, and asset allocations across multiple accounts.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API