Description: Blockpit.io is an online tax reporting and portfolio tracking platform for cryptocurrencies. It automatically imports trading data to generate capital gains reports and tax forms needed to comply with regulations.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

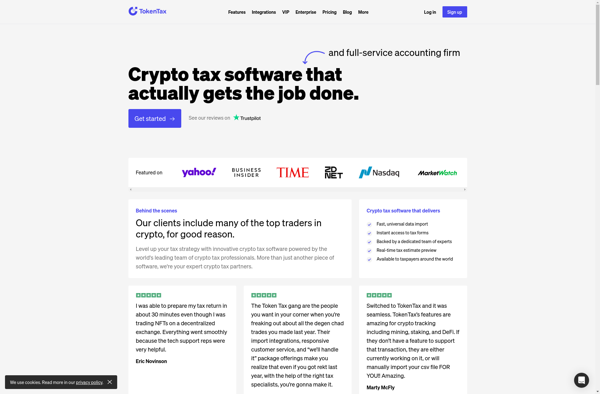

Description: TokenTax is cryptocurrency tax software designed to help users track, calculate, and report their cryptocurrency taxes. It connects to major exchanges and wallets to auto-import trades and allows users to manually input transaction data as well. TokenTax can generate necessary tax forms and documents.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API