TokenTax

TokenTax: Cryptocurrency Tax Software

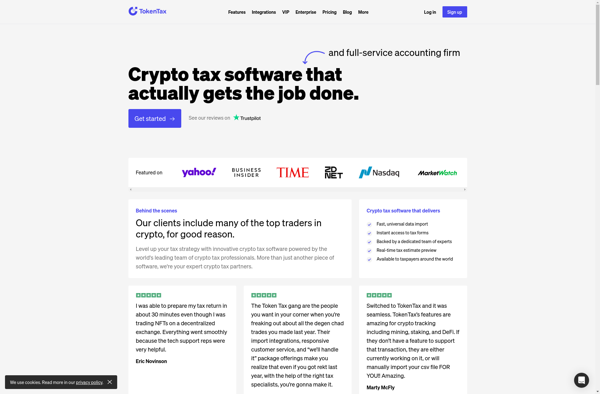

Automate your cryptocurrency tax calculations with TokenTax, a software designed to connect to major exchanges and wallets, auto-import trades, and generate necessary tax forms and documents.

What is TokenTax?

TokenTax is a cryptocurrency tax reporting software that helps users properly file their digital asset transactions with tax authorities. It connects to major cryptocurrency exchanges and wallets to automatically import trade history and calculate gains, losses, income amounts, and more based on that data.

Key features of TokenTax include:

- Auto-import from leading exchanges (Coinbase, Binance, etc.) and wallets to track trading activity

- Manual data upload support for adding transactions not covered by direct connections

- Accurate capital gains, losses and income calculations across thousands of assets

- Preparation of necessary cryptocurrency tax forms like 8949, Schedule D, FBAR, etc for filing

- Deductible transaction categorization and income tagging

- Robust transaction details viewer and tax reports for transparency

- Access to expert CPAs for answering tax & compliance questions

- Portfolio tracking with gain/loss visibility over time

By centralizing all cryptocurrency transaction data across different platforms and accurately calculating tax liability based on that information, TokenTax saves crypto investors significant time and minimizes risk of errors when filing taxes. Its lineup of connections, automated import capabilities, and powerful reporting features make it a top choice for cryptocurrency tax software.

TokenTax Features

Features

- Automatic import of trades from major exchanges and wallets

- Manual entry of transaction data

- Tax form and document generation

- Support for multiple cryptocurrencies

- Cost basis tracking

- Detailed reporting and analytics

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best TokenTax Alternatives

Top Bitcoin & Cryptocurrency and Tax Reporting and other similar apps like TokenTax

Coinpanda

BearTax

Blockpit.io