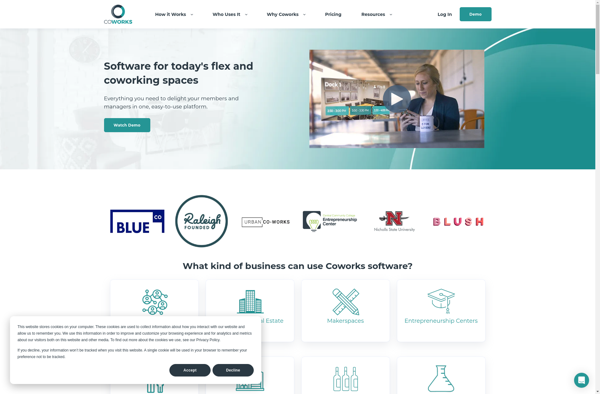

Description: Coworks is a workspace management software designed for coworking spaces and flexible office providers. It allows managing memberships, billing, resource booking, access control, and analytics from a single platform.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: SortFolio is a portfolio analysis software designed specifically for sorting stocks based on factors like performance, risk, valuation, etc. It allows investors to test and evaluate various stock picking strategies and algorithms.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API