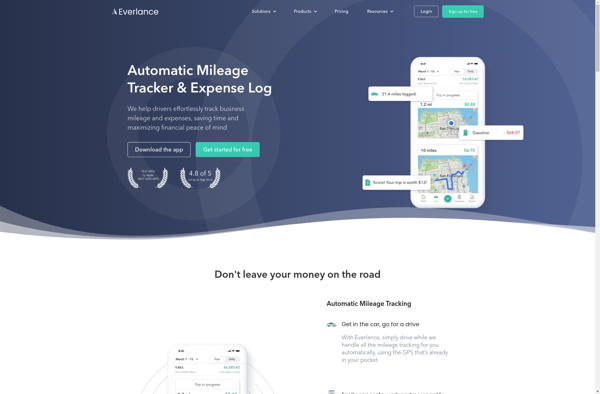

Description: Everlance is a mileage and expense tracker app designed for rideshare drivers, delivery drivers, sales reps, and other self-employed individuals who need to track miles for tax deductions. The easy-to-use automatic mileage tracker provides accurate mileage reports.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

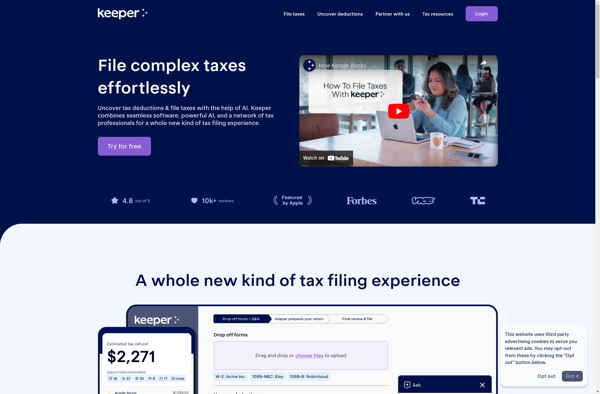

Description: Keeper Tax is tax software designed specifically for rideshare drivers, delivery drivers, and other gig workers. It helps track income and deductions and maximize tax write-offs.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API