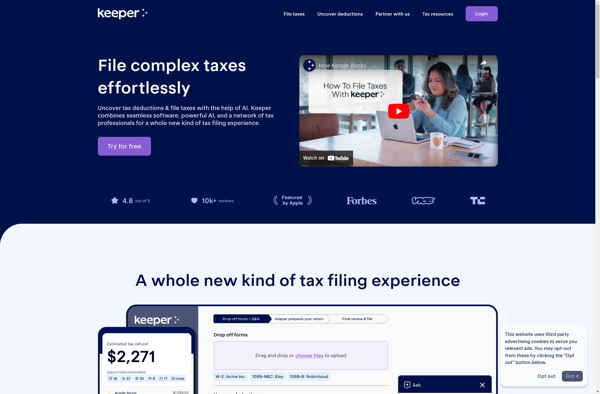

Keeper Tax

Keeper Tax: Tax Software for Gig Workers

Tax software designed specifically for rideshare drivers, delivery drivers, and other gig workers to track income and deductions and maximize tax write-offs.

What is Keeper Tax?

Keeper Tax is an easy-to-use tax preparation and filing software designed specifically for on-demand and gig economy workers like rideshare drivers, delivery drivers, freelancers, and independent contractors. It simplifies the tax filing process by helping users track tax deductible business expenses and mileage throughout the year.

Some key features of Keeper Tax include:

- Automatic mileage and expense tracking

- Maximizing tax deductions and write-offs

- Easy tax filing and e-filing

- Year-round unlimited expert support

- Guaranteed maximum refund or your money back

By keeping tabs on deductible business expenditures as they happen, Keeper Tax enables on-demand workers to reduce their taxable income and take advantage of every available tax break. The intuitive mobile app and web dashboard make expense and mileage tracking simple. Come tax time, Keeper Tax makes filing fast and straightforward even for complex rideshare tax situations.

Keeper Tax Features

Features

- Automatically tracks miles driven for tax deductions

- Imports tax documents from Uber, Lyft, DoorDash, etc

- Estimates quarterly taxes owed

- Maximizes tax deductions for gig workers

- Creates Schedule C tax forms

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Keeper Tax Alternatives

Top Business & Commerce and Tax Software and other similar apps like Keeper Tax

Here are some alternatives to Keeper Tax:

Suggest an alternative ❐Quicken

Intuit QuickBooks

FreshBooks

Xero

ZipBooks

InvoiceTrackr

FlyFin

Everlance

Hurdlr