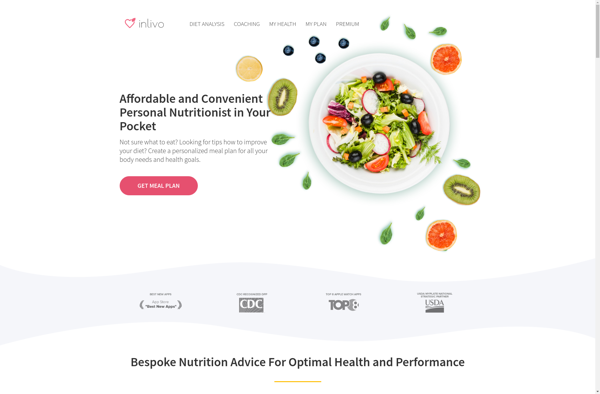

Description: Inlivo is a customer data platform designed to help businesses unify their customer data from multiple sources. It includes data collection tools, segmentation options, and integrations with marketing platforms to better target and personalize messaging across channels.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

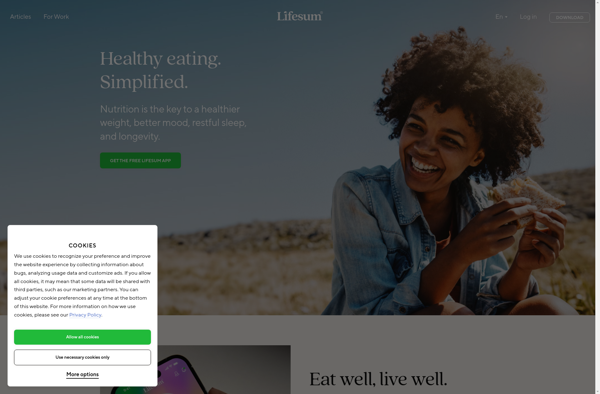

Description: LifeSum is a personal finance and budgeting software that helps users manage spending, create budgets, set money goals, track investments, schedule bill payments, and more. It has an easy to use interface and includes a variety of financial tools.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API