LifeSum

LifeSum: Personal Finance & Budgeting Software

LifeSum is a personal finance and budgeting software that helps users manage spending, create budgets, set money goals, track investments, schedule bill payments, and more. It has an easy to use interface and includes a variety of financial tools.

What is LifeSum?

LifeSum is a comprehensive personal finance software program designed to help individuals and families manage all aspects of their financial lives. It includes powerful features to track income, spending, investments, budgets, transactions, goals, and more in one centralized location.

With LifeSum, users can:

- Create and monitor budgets: Set up budgets for all monthly expenses and spending categories, then track how actual spending matches up to the budgeted amounts.

- View net worth: See all assets and liabilities combined into one regularly updated net worth statement.

- Connect bank and credit card accounts: Sync external accounts automatically to have all transactions imported seamlessly into LifeSum.

- Set and monitor financial goals: Make short or long term savings goals like building an emergency fund or retirement savings, then track progress.

- Schedule bill payments: Stay on top of bill due dates with auto-reminders and make online payments directly within LifeSum.

- Manage investments: Link investment and retirement accounts to view balances, transactions and rate of return in one secure place.

- Monitor financial help: View all recurring income, debt, and financial obligations together to manage cash flow.

- Generate numerous reports: Create custom reports on spending analysis, financial trends, asset allocation, and other critical data.

LifeSum has an intuitive and user-friendly interface that brings the full financial picture together in one place, allowing users to make smarter money management decisions across all areas of their financial lives.

LifeSum Features

Features

- Budgeting

- Expense Tracking

- Bill Pay

- Goal Setting

- Investment Tracking

- Net Worth Tracking

- Spending Insights

- Customizable Categories

- Calendar View

- Mobile App

- Bank Sync

- Reporting

- Dark Mode

Pricing

- Freemium

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best LifeSum Alternatives

Top Business & Commerce and Personal Finance and other similar apps like LifeSum

Here are some alternatives to LifeSum:

Suggest an alternative ❐MyFitnessPal

Fitbit

Nutrydex

Eat This Much

YAZIO

FatSecret

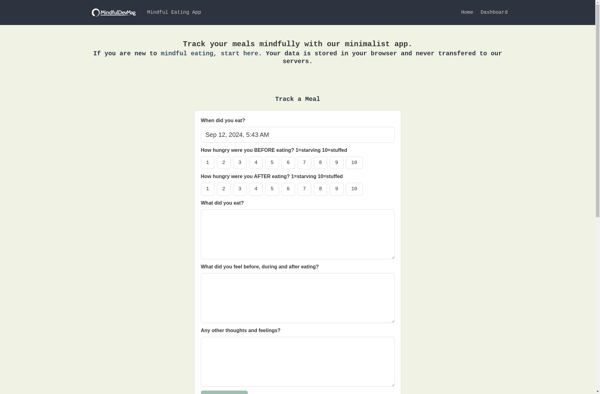

Mindful Eating App

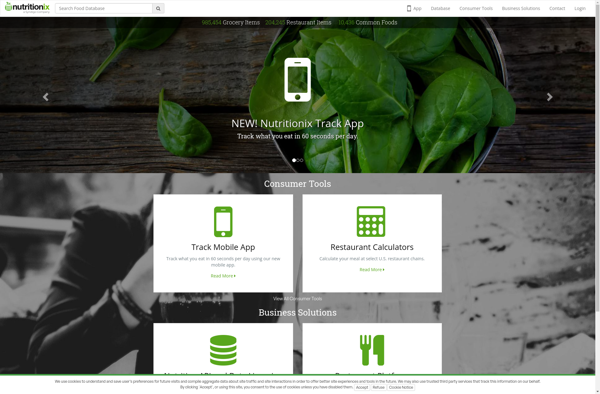

Nutritionix Track

Poundaweek

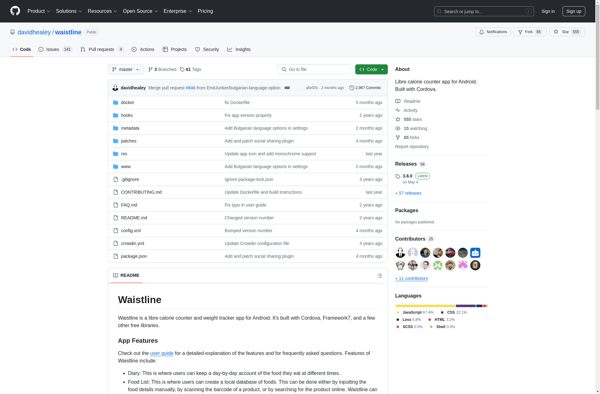

Waistline

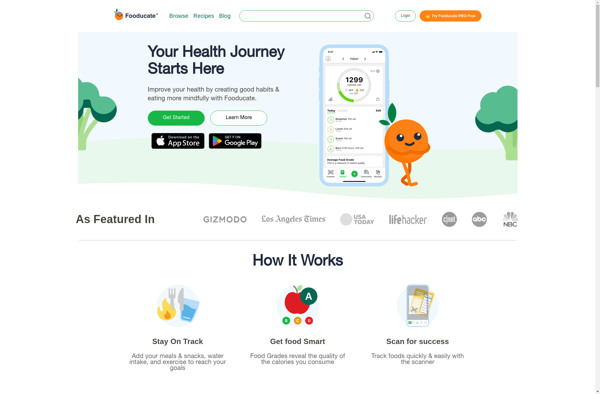

Fooducate

CalorieTracker.io

Bitesnap

Microsoft Band

Runtastic Balance

SternFit

Inlivo

HeadUp Labs

Digifit

Fittr Pro

STRAFFR

Dutrition

Calorie Counter and Diet Tracker

Max Fitness Personal Trainer

Joy Health Tracker

IEatHealthy

EatHealthy Tracker

OmNom Notes

CalorieBase

Moderation

Calorious

MiniBite

My Calorie Limit