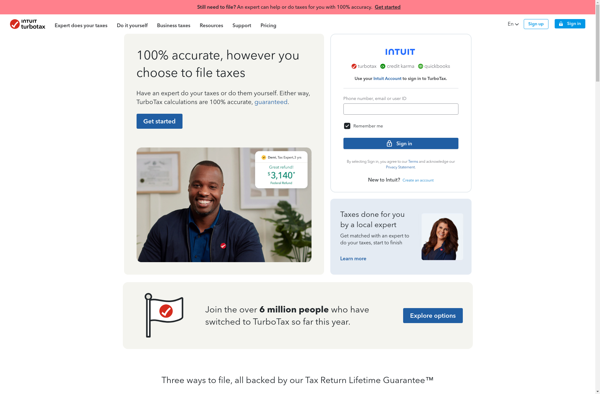

Description: Intuit TurboTax is tax preparation software that helps individuals and small businesses file federal and state tax returns. It uses a question-and-answer format to guide users through the process step-by-step.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: TaxPoint is tax preparation software designed to help accountants, tax professionals, and small businesses prepare, file, and manage taxes. It offers features like automated form filling, data importing, calculation tools, document management, and e-file capabilities.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API