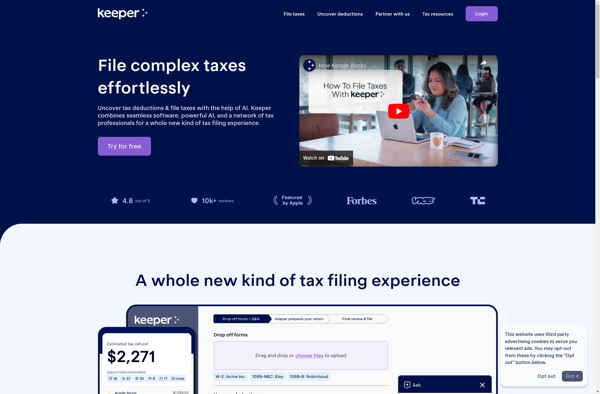

Description: Keeper Tax is tax software designed specifically for rideshare drivers, delivery drivers, and other gig workers. It helps track income and deductions and maximize tax write-offs.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: InvoiceTrackr is a cloud-based invoicing and time tracking software designed for freelancers and small businesses. It allows users to easily create professional invoices, track time and expenses, manage billing and payments, and gain insights into their business financials.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API