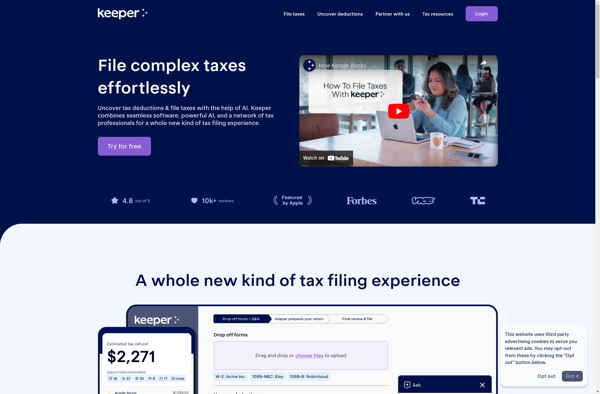

Description: Keeper Tax is tax software designed specifically for rideshare drivers, delivery drivers, and other gig workers. It helps track income and deductions and maximize tax write-offs.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

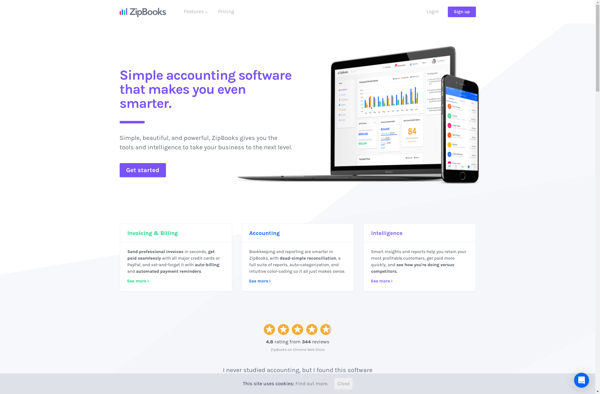

Description: ZipBooks is an easy-to-use online accounting and invoicing software designed for small businesses. It allows users to track income and expenses, create professional invoices, accept online payments, generate financial reports, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API