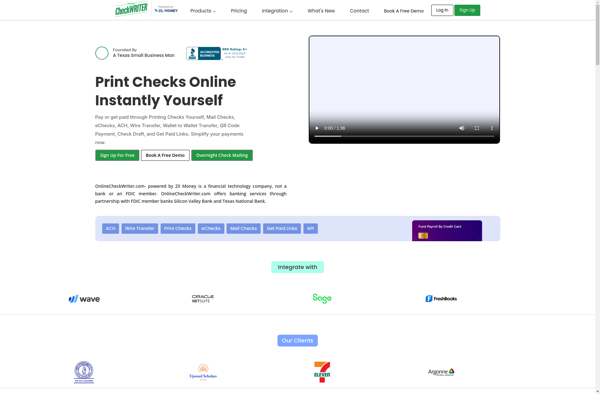

Description: An online check writer is a web-based application that allows users to create and print customized checks without having to purchase check stock or a dedicated check printing machine. It eliminates the need to handwrite checks.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

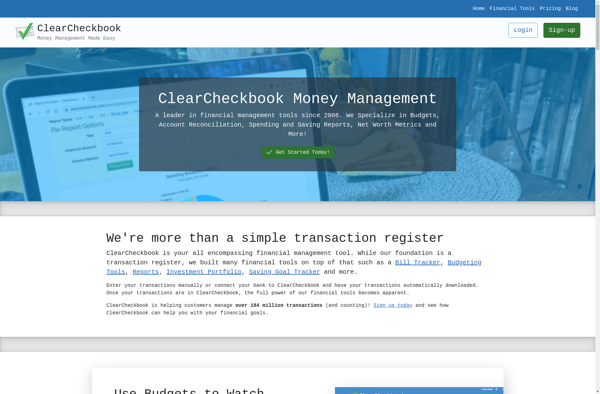

Description: ClearCheckbook is a personal finance app that helps users track spending, create budgets, and manage money. It has an easy-to-use interface for entering transactions and features reporting tools, bill reminders, and automatic syncing across devices.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API