Description: A personal finance planner is software designed to help individuals manage their finances more effectively. It typically includes features to track income, spending, savings, investments, debt, and net worth over time. The goal is to gain control of your money so you can budget better, save more, reduce debt, and ultimately achieve your financial goals.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

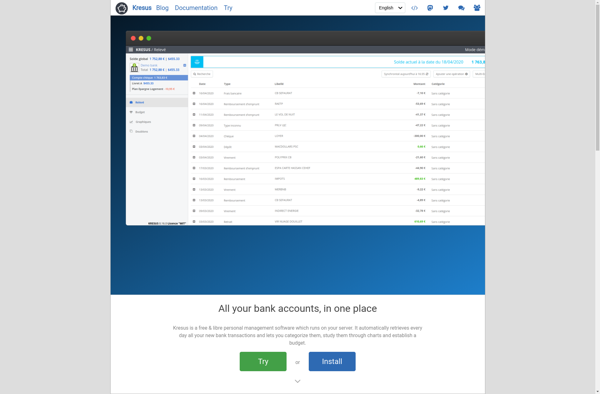

Description: Kresus is an open-source personal finance manager. It allows users to track their expenses, income, budgets, accounts, and investments. Kresus has features for transaction import, reports, graphs, and customization.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API