Personal Finance Planner

Personal Finance Planner: Manage Your Money Efficiently

A personal finance planner is software designed to help individuals manage their finances more effectively. It typically includes features to track income, spending, savings, investments, debt, and net worth over time. The goal is to gain control of your money so you can budget better, save more, reduce debt, and ultimately achieve your financial goals.

What is Personal Finance Planner?

A personal finance planner is a type of software application designed to assist individuals with managing their personal finances in an organized and effective manner. The main goal of this type of software is to provide tools and insights that enable users to take control of their financial situation, budget smarter, reduce unnecessary expenses, pay down debt, save and invest for the future, and work towards specific financial goals.

Key features found in most personal finance planners include the ability to:

- Link various bank, investment, loan, and other financial accounts so all information is in one place

- Set up and track budgets, including income, fixed costs, variable spending, savings targets, etc.

- Review current spending patterns and categories to identify areas to cut back

- Establish short-term and long-term saving goals for emergencies, retirement, big purchases, etc.

- Project net worth over time under different savings and investment return scenarios

- Get reminders and alerts related to bill payments, low account balances, or over-budget spending

- Access educational content to improve financial literacy and money management skills

Personal finance planners aim to provide consolidated, real-time visibility into someone's overall financial life along with analytics and forecasting tools to provide insights. This assists with day-to-day money management while also helping to plan for the future. The end result is better control, less stress, and progress towards financial goals.

Personal Finance Planner Features

Features

- Budgeting and expense tracking

- Income and bill management

- Savings and investment tracking

- Debt management

- Net worth calculation

- Goal setting and progress tracking

- Categorization of transactions

- Reporting and analytics

- Customizable dashboards

- Mobile app integration

Pricing

- Free

- Freemium

- Subscription-Based

Pros

Cons

Reviews & Ratings

Login to ReviewThe Best Personal Finance Planner Alternatives

Top Home & Family and Personal Finance and other similar apps like Personal Finance Planner

Here are some alternatives to Personal Finance Planner:

Suggest an alternative ❐GnuCash

Linxo

GoDBLedger

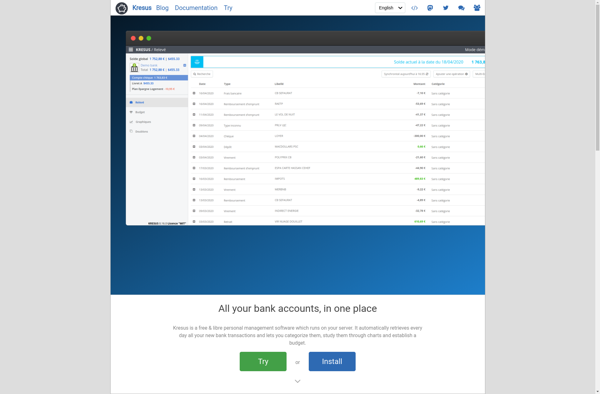

Kresus

My Budget

BudgetGrid

Benson Bank CMS