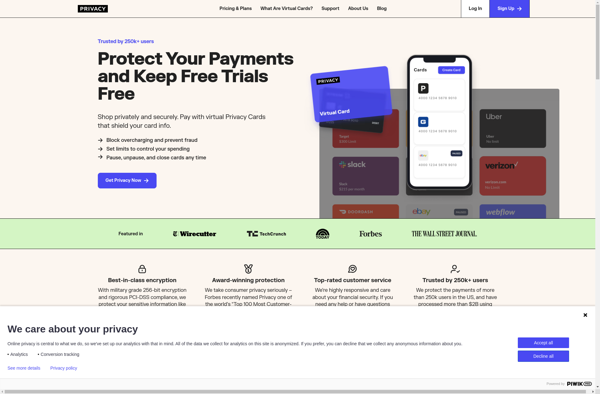

Description: Privacy.com is a free service that generates virtual debit and credit cards to help protect your financial information and manage subscriptions. It allows you to set spending limits and pause or cancel cards anytime.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

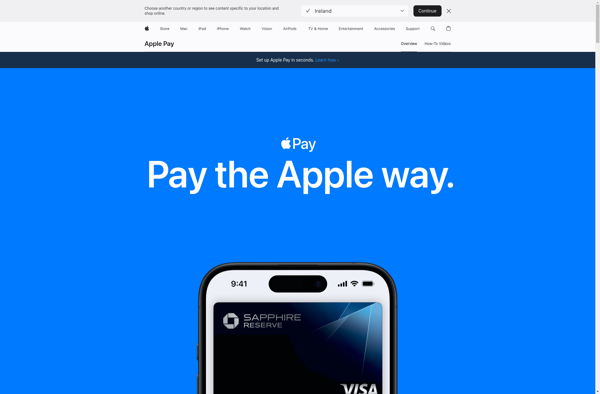

Description: Apple Pay is a mobile payment and digital wallet service by Apple that allows users to make payments in person, in iOS apps, and on the web. It uses NFC technology and is supported on iPhone and Apple Watch.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API