Description: Schwab is an online brokerage firm that provides a trading platform and investing services for individual investors. It allows customers to trade stocks, ETFs, options, mutual funds, and fixed income securities.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

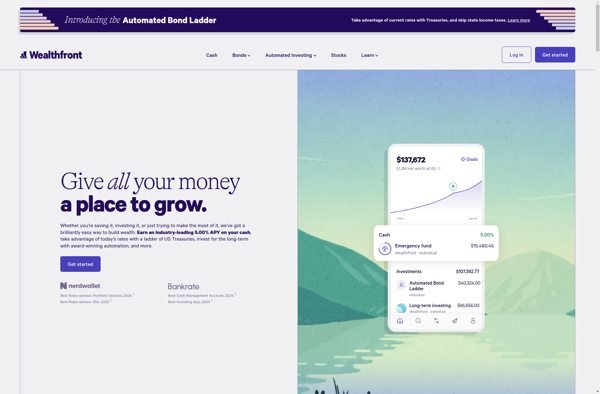

Description: Wealthfront is an automated investment service and robo-advisor that uses algorithms and software to build and manage customized investment portfolios based on a client's financial situation and goals. It aims to provide long-term, tax-efficient investing at low fees.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API