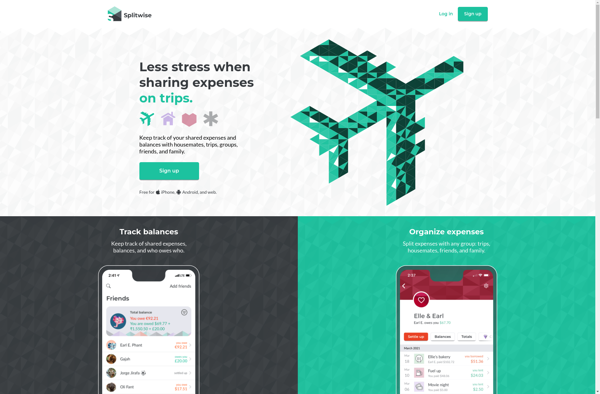

Description: Splitwise is a free online tool that helps groups of people share expenses and track balances owed. It allows roommates, couples, groups of friends, family members, and others to easily track shared bills, rent, vacations, event costs and more. The interface is user-friendly and it syncs across mobile and desktop.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: BillMonk is a free online application that allows roommates, couples, or friends to easily split shared bills and expenses. It tracks who owes what to whom over time, avoiding awkward conversations and simplifying shared finances.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API