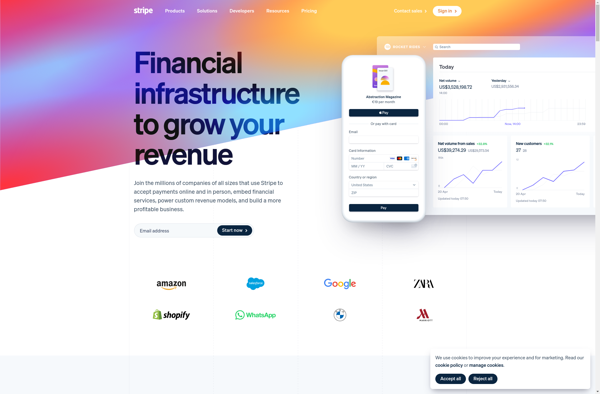

Description: Stripe is an online payment processing service that allows individuals and businesses to accept payments over the Internet. It provides the technical, fraud prevention, and banking infrastructure required to operate online payment systems. Stripe aims to simplify payment processing with easy-to-use APIs and excellent documentation.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Neteller is an online money transfer service that allows users to make deposits and payments to merchants. It supports online gambling, forex trading, and other services. Neteller is owned by Paysafe Group.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API