Description: TD Ameritrade is an online brokerage firm that offers investing and trading services, including stocks, options, ETFs, mutual funds, futures, forex, bonds, and more. It has $1.7 trillion in client assets and offers advanced platforms, research tools, education, and 24/5 customer service.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

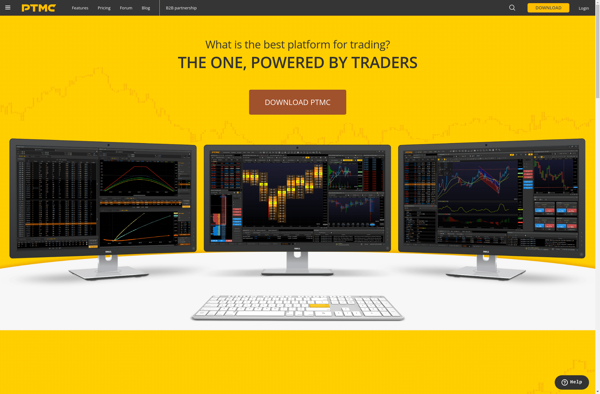

Description: PTMC is a private industry-wide tool designed to facilitate information sharing between participating companies, helping them prevent supply chain disruptions. It aims to modernize communication and data sharing in the supply chain.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API